Step by Step MM-CIN Training Documentation

Topics covered:

1. Excise Transactions

2. Capital Goods Purchase

3. Returnable/ Non

Returnable Gate Pass

4. Import Purchase Cycle

5. Vendor Return &

Excise Reversal

1 COUNTRY INDIA VERSION

1.1 Procedure for Claiming CENVAT for Raw

Materials

1.1.1 Create the Purchase Order (ME21N)

Follow standard PO creation process

1.1.2 Gate Entry (/cvs/gnt01)

Enter the PO No in the Field, and then all the

items against the Po will be shown. Enter the Relevant Quantity, Enter the LR

no, Vehicle No, Vendor Excise No, In the Text Enter the Transporter Name.

Security ID Select from the Drop Down Menu.

Menu Path: Logistics à Materials Management à Inventory management àGoods movement à goods receipt à for purchase orderà Purchase order no.

Known (MIGO)

a. Enter the PO number and click on Execute button as shown below.

b. Enter the Gate Entry No

It will show the gate Entry Quantity of the in the Quantity tab in field

Quantity in Unit of entry.

c. Enter receiving Storage Location in Where tab. Here check the stock type in which material is going to receive. If some text needs to be added regarding the goods receipt enter it in Text field. If it subjected to batch Management then enter the Vendor Batch No as well as In-house batch no. If you want to Split the Quantity then Click on, Then Enter the Batch, Quantity etc. After doing all these thing go to Classification Enter all the Parameter.

d. Click on Item OK

Checkbox – at this point of time system will show relevant information of

excise for which Excise Invoice tab will appear in the Header screen as shown

below, select Only Capture Excise Invoice on this tab and put the Vendor Excise

Invoice no check the Excise group.

e. Check the Excise Details

related to the received material in Excise Item tab in Detail Data screen as

shown below.

Post ![]() button

to save the Goods receipt, system will generate the Goods receipt Document.

System will automatically update the Part I register as soon as the GR is made.

button

to save the Goods receipt, system will generate the Goods receipt Document.

System will automatically update the Part I register as soon as the GR is made.

1.1.2 Post the Captured Vendor’s Excise

Invoice

Go to CIN transaction

Menu Path: User menu à Indirect taxes à Procurement à Excise invoice à Incoming Excise invoice à Individual Processing à

Capture/Display (J1IEX)

a. Select Post Excise

Invoice and Vendor in windows above the Header.

b. Enter Goods Receipt

Document number generated in STEP 2 and press ENTER or Click on Execute ![]() button.

button.

c. Following screen will appear as shown below.

d. Enter Vendor Excise

Invoice Number, Excise Invoice Date, Excise group – (or any other appropriate

excise group).

e. If material had directly came from different vendor, Enter vendor code in Ship from field in miscellaneous tab.

f. If Excise Invoice is faulty and still want to take the credit for the excise invoice, enter the rejection code.

g. Check the Material

Chapter Heading, Material type in Item tab in Detail Data screen.

h. Check the Quantity in Quantity tab

i. Check the Duty rate in Duty rate tab.

j. Check duty values and Tax amount for the material in Duty value tab.

After Check Click on Simulate Button to check

the G/L Entries.

Press save button ![]() to

post the entry, Excise Invoice will be captured and following screen for

information will be displayed.

to

post the entry, Excise Invoice will be captured and following screen for

information will be displayed.

1.1.3

Display Excise Invoice

Menu Path: User menu à Indirect taxes à Procurement à Excise invoice à Incoming Excise invoice à Individual Processing à

Change/Display/Post/Cancel (J1IEX)

Select Display and Vendor Excise Invoice in windows

above the Header. Here you can display both the Part I and Part II entries in

one document only. Check the Excise registers in which entry is made.

1.2 Procedure for claiming

CENVAT for Capital Items

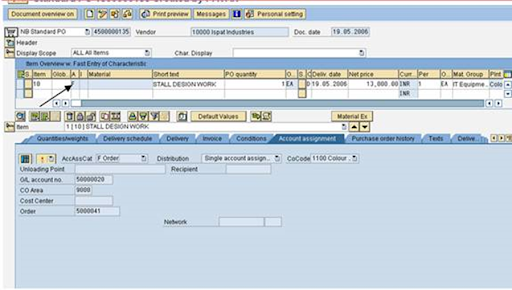

1.2.1 Create the Purchase Order for Capital

goods

Follow standard PO creation process and note the following things

In the Account assignment category enter “F”.

The system will prompt to put the Order no as well as G/L account

no in the account assignment tab.

All the other details like VAT or CST you will have to maintain.

Maintain the Tax code.

The system will prompt to put the Order no as well as G/L account

no in the account assignment tab.

All the other details like VAT or CST you will have to maintain.

Maintain the Tax code.

Check the Item OK check box and press Check ![]() button

in tool bar to check the entries

button

in tool bar to check the entries

g. Press Post ![]() button

to save the Goods receipt, system will generate the Goods receipt Document.

System will automatically update the Part I register as soon as the GR is made.

button

to save the Goods receipt, system will generate the Goods receipt Document.

System will automatically update the Part I register as soon as the GR is made.

l. Press Enter, following

screen will appear

1.2.3 Post the Captured Vendor’s Excise

Invoice

Go to CIN transaction

Menu Path: User menu à Indirect taxes à Procurement à Excise invoice à Incoming Excise invoice à Individual Processing à

Capture/Display (j1iex)

a. Select Post the

Excise Invoice and Goods Receipt in windows above the Header.

b. Enter Vendor Excise no

generated above.

If material had directly came from different vendor, Enter vendor

code in Ship from field in miscellaneous tab.

a. If Excise Invoice is

faulty and still want to take the credit for the excise invoice, enter the rejection

code.

b. Check the Material

Chapter Heading, Material type in Item tab in Detail Data screen.

c. Check the Quantity in

Quantity tab

d. Check the Duty rate in

Duty rate tab.

e. Check duty values and Tax amount for the material in Duty value tab.

f. Check the Part I entries, which are created immediately after the GR in Part I tab.

h. Tick the Item OK check

box and Press ![]() button

to check the entries.

button

to check the entries.

i. Press save button ![]() to

post the entry, Excise Invoice will be captured and following screen for

information will be displayed.

to

post the entry, Excise Invoice will be captured and following screen for

information will be displayed.

1.2.4Display Excise Invoice

Menu Path: User menu à Indirect taxes à Procurement à Excise invoice à Incoming Excise invoice à Individual Processing à Change/Display/Post/Cancel

Select Display and Vendor

Excise Invoice in windows above the Header. Here you can display both the

Part I and Part II entries in one document only. Check the Excise registers in

which entry is made.

1.4

Sub-contracting

without Payment of Excise Duty

When you issue materials to a subcontractor, you need to keep

track of what materials you have issued and when they have to be returned by.

The reason for this close

monitoring has to do with India’s tax law. Under excise law 57AC, when you send

materials to a subcontractor for processing, you are not required to pay any

excise duty, even though the materials have left your premises. However, if the

materials have not been returned to you within a given length of time specified

by the law (in 2000, 180 days), you will have to reverse any excise credit that

you posted when you purchased the materials. In the case of materials that you

have manufactured in-house, you will have to post credit entries to the extent

of the CENVAT rate of the assessable value of the materials.

1.4.1 Create Sub-Contracting Purchase order with Reference of Purchase

Requisition

To create a subcontract order, proceed as follows:

1. Purchase Requisition will create automatically through Maintenance

Order (IW31)

2. Purchase Requisition will have the reference of Maintenance Order.

3. Create Purchase Order with reference of Purchase Requisition (ME21N)

4.

Release the Purchase Order (ME28)

4. Check and Save the Purchase Order. ![]()

1.4.2 Create Gate Pass (Returnable/ Non Returnable)

for the materials sent out for Fabrication/ Servicing/ Irradiation, etc…

1. Enter Transaction code ZRGP on comm.-and field

2. Select Create from Pull down list, Issue and Purchase Order from another pull down list.

3. Enter the subcontracting purchase order number

4. Enter all the details in the header

5. After posting Gate Pass, to take Print Out, Choose Display à Issue à Gate Pass in ZRGP only, here put Gate Pass No. & press Enter

then choose Edit à Print, Here You can see Print Preview & then take

print out.

1.4.3 Post Goods

Receipt (MIGO) or Service Entry Sheet (ML81N)

Menu Path: Logistics à Materials Management à Inventory management àGoods movement à goods receipt à for purchase orderà Purchase order no. Known (MIGO)

Enter the Purchase Order number

& Create Service Entry Sheet as per the Method suggested in User Manual of

Services.

1.4.4 Reconcile Gate

Pass

1. Enter the Transaction code ZRPP on

command field

1.4.5

Gate Pass Reports

You use this report to get a list of Gate Pass (subcontracting

challans). Depending on what selection criteria you enter, you can use it for

finding out:

Enter Transaction code ZRGP on Command Field

a) Which challans are still with the

subcontractor and are due back the following week

b) Which challans you can make a re credit

for

c) Quantity issued to Vendor

d) Quantity Received from Vendor

1.4.6 Change Gate Pass

Enter the Transaction Code ZRGP on

Command Field

Enter the challan number select ![]()

The challan is displayed.

1.4.7Display Gate Pass

Enter the Transaction Code ZRGP on

Command Field

Enter the challan number select ![]()

The challan is displayed.

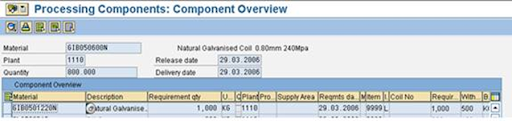

SUBCONTRACTING SCENERIO (SLITTING

PURPOSE)

Crate a PO putting Item Category L. Put the

Material which will come from the Vendor Site.

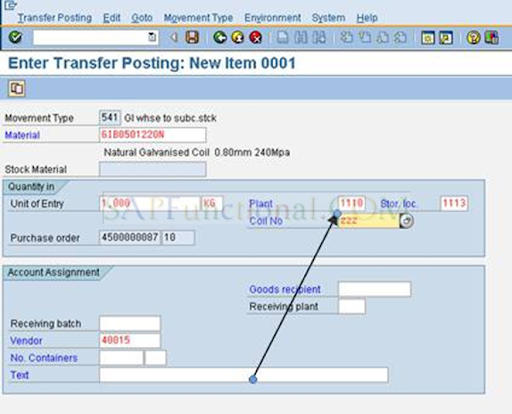

Then Goto MB1B Transaction

Click on to Purchase Order. Put the Purchase Order. Then Click on Adopt

Details.

Put The Batch No here, which

you are going to provide to the Vendor. Then save it. Note Down the Material

Document NO (490000000684)

If it is Excisable then Create a Subcontracting Challan (J1IF01). In Subcontracting challan creation put the Material Document which is created during the MB1B code(490000000684).

If the Material Assessable Value isn’t maintained then maintain it on J1ID.

Then Post the Document.

After Doing all these thing Repeat the Step for creating a Returnable Gate Pass, which has been already described. Then Perform the Gate Entry as Mentioned above. Do the GR in MIGO (T code). Put the Purchase order no.

Enter the Quantity, Batch no for the Incoming as well as Consumed

Material.

Reconciliation of Subcontracting Challan (J1IFQ)

Enter the Material Document which was created during GR

(5000000274)

1.5 Procedure for Claiming

CVD benefit for Imported Material.

1.5.1 Create Purchase

order for imports

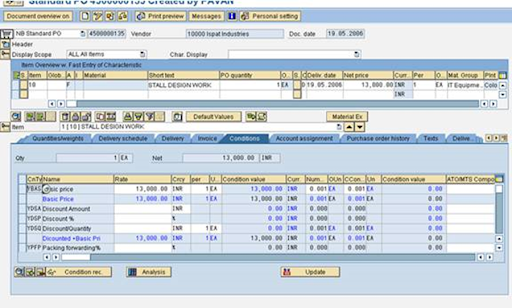

Create a purchase order for the materials that you want to order

using the standard procedure as mentioned in above documentation but when you

fill out the item information.

Conditions tab

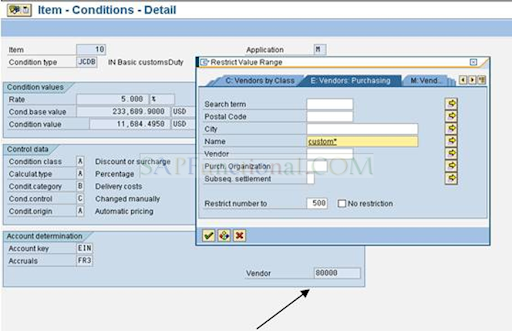

Select the

countervailing duty (CVD) condition .

a. In the Rate

field, enter the Rate of CVD that will be levied on the material when it

arrives at customs.

b. In the Vendor field,

enter the vendor master record that you have created for the customs office.

To do this, select the CVD condition, which is

marked by arrow, and then press button ![]() in

the conditions tab.Enter the custom vendor number in the vendor

field.

in

the conditions tab.Enter the custom vendor number in the vendor

field.

Enter the custom vendor number in the vendor field.

The vendor ships the goods to you.

When the goods arrive in India, they go through customs. The

customs officers issue a bill of entry for the goods, which is in effect an

invoice for the CVD on the goods. Once they have inspected the goods, they send

them on to you.

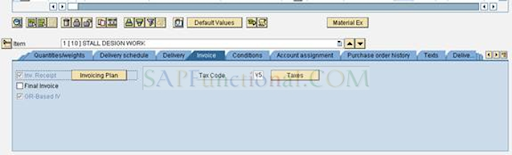

1.5.2 Entering invoices for Bill of Entry

(MIRO)

The goods arrive at your

plant, together with the bill of entry. In order to record the bill of entry in

the system

The excise clerk enters

an invoice for the bill of entry.

To enter the invoice for bill of entry follow

standard invoice verification procedure but make sure you observe following

Header Data

- Basic data

tab

- In the Amount field,

enter the amount of countervailing duty (CVD) stated on the bill of entry

in rupees. Also enter the amount of other custom duties if any.

- Do not enter any other taxes.

On the PO reference tab, enter data as follows:

Enter the number of the purchase order related to this delivery.

If you only created one purchase order for the goods, enter

the purchase order number and select planned delivery costs.

If you sent more than one purchase order to the vendor and

it sent you all of the ordered materials together in one shipment:

ii. Enter all of the purchase order numbers in the table.

iii. Select planned delivery costs.

iv. Select Deliveries and deselect Returns.

In both cases, the system displays the line items in the line item

overview

For each line item:

In the Amount field, enter the amount of

CVD on the item (if you have more than one item, you may have to work the

amount out manually).

In the Quantity field, enter the quantity

of goods on the invoice.

Enter a zero-rated tax code.

A dialog box appears with a list of the postings that will be made

to Financial Accounting (FI).

Note down the document

number (CUSTOM Invoice number)

Perform The Gate Entry

Process As per above Mentioned

1.5.3 Capturing Excise invoice (Bill of

Entry)– (J1IEX)

Menu path: India ® Excise Invoice ® Procurement ®Localisation menu (J1ILN)

Capture/Display.® Individual Processing ®Incoming Excise Invoice

In the top line:

Select Capture Excise Invoice

Select Purchase Order.

Enter the purchase order related to the bill of

entry.

Choose ![]()

A dialog box appears.

3.

Enter the number of the

invoice that you entered for the bill of entry and choose ![]()

If you need to enter any other purchase orders, enter the number

in the top line as for step 3.

Note that this time; you do not need to enter the invoice number.

Enter other data as required.

Note that the countervailing duty is displayed in the basic excise

duty fields.

Enter the bill of entry number and date in the excise invoice

number and Doc date field respectively.

Capture The Excise Invoice By Entering the Vendor Excise Invoice

no at the time of GR

Post Cenvat (J1iEX) By Entering the Invoice no

After doing it, do the Simulation

After Simulation, the system posts the CENVAT (CVD Amount) and

creates a corresponding entry in Part II or the appropriate excise register

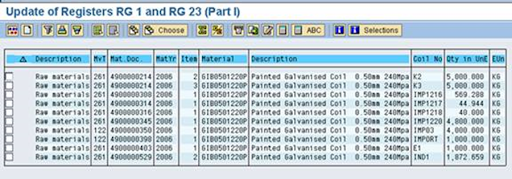

1.6 Creation of Excise Registers – (J1I5)

You follow this procedure to create the excise registers.

Three steps are to be followed for creation

and printing of the excise registers

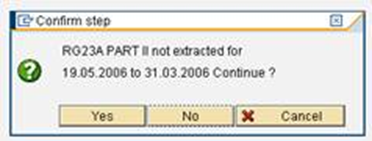

1.6.1 Updating of Registers (RG23 A).

The

updating of registers includes receipts and issues.

The classification of receipts and issues is done by selecting the appropriate classification as per the table given below.

1.6.1.1 Receipt updating of Registers (RG23A)

Menu Path: India Localisation menu

(J1ILN) à Indirect Taxes ->

Registers ->Excise Tax -> Update RG 23A/C Issues and RG 1.

On the selection screen, you specify

- Which

documents you want to cover:

- Enter

general organizational details in the Company details group box.

- Enter

details about the documents that you want to include in the register, in

the Document header and Document details group boxes.

Select movement type 101 and storage

location.

Also select appropriate classification type

(RMA) in case of receipt from manufacture.

1.6.1.1 Receipt updating of Registers (RG23A)

Menu Path: India Localisation menu

(J1ILN) à Indirect Taxes ->

Registers ->Excise Tax -> Update RG 23A/C Issues and RG 1.

On the selection screen, you specify

- Which

documents you want to cover:

- Enter

general organizational details in the Company details group box.

- Enter

details about the documents that you want to include in the register, in

the Document header and Document details group boxes.

Select movement type 101 and storage

location.

Also select appropriate classification type

(RMA) in case of receipt from manufacture.

Select register RG23 A, in the Registers group box

First select entries & click on Simulate ![]() icon.

icon.

The signal becomes ![]()

Then put tick in checkbox and select ![]() for

updating the register.

for

updating the register.

Register is updated and the screen looks as

given below.

1.6.2 Data Extraction– J2I5

Menu

path: India localization menu à Indirect taxes à Registers à Excise Tax à Extract (J2I5)

On

the selection screen enter the excise group, start date (of the month) and end

date (of the month) and select the registers for which the data extraction is

required.

1.6.3 Register printout– J2I6

You use this report to print out your excise registers.

Menu

path: India localisation menu à indirect taxes à Registers à Excise Tax à Print utility program (J2I6)

On

the selection screen select the registers which are to be printed.

Select

![]()

On the selection screen select the excise

group, start date (of the month) and end date (of the month).

Select

![]()

Select suitable printer and print the

register.

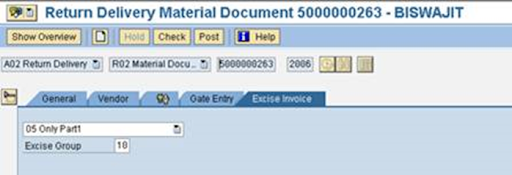

1.7 Procedure for creating Excise Invoice for vendor returns

1.7.1 Create Return Delivery

Documents through MIGO

Menu Path: Logistics à Materials Management à Inventory Management à Goods Movement à MIGO-Goods Movement (MIGO)

Indicates the business transaction that you want to enter in the system and give the Original GRN Document number

Enter the Quantity to be return on Quantity Tab

Enter the Reason for movement on where Tab and movement type is 122 for Return Delivery to vendor

Select the Goods Issue Indicator IPD

Check and Post the Document

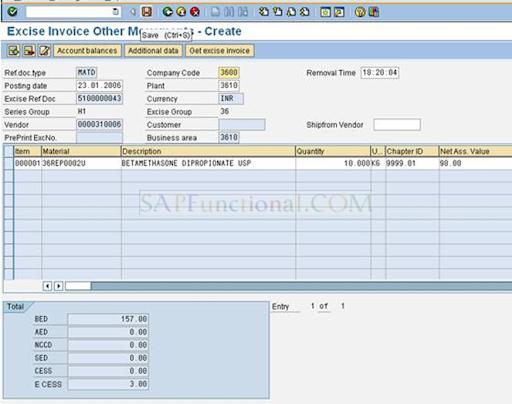

1.7.3 Create and Post Excise

Invoice for vendor with ref of Return Delivery Documents

Menu path: India localisation menu à Indirect taxes à Sales/Outbound Movements à Excise Invoice à For Other Movements à Excise Invoice for Other Movements (J1IS)

Here Click on Create Icon first to create Outgoing

Excise Invoice

Enter the Reference document number, Reference

document type, Document year, and Series group, Excise group and Vendor number.

For the material the Net Assessable Value, Base Value and all Excise duties will pick automatically from Vendor’s Excise Invoice captured & posted already at the time of GRN.

1. LR No.

2. Vehicle No.

Here select each option to maintain the desired data

as following & click on “Details” icon.

Here maintain desired data as per your requirement & save the text

After saving you will get following result. Note down the Excise Invoice No.

Here click on accounting tab to see the Accounting

Entries generated.

Menu path: India localisation menu à Indirect taxes à Sales/Outbound Movements à Excise Invoice à For Other Movements à Post and Print (J1IV)

Enter the Series group, Output type JEXC (Standard)

and Excise Transaction Type is OTHR and Execute

Select the Excise invoice number

to get Print.

No comments:

Post a Comment