Fundamental of Stock / Share

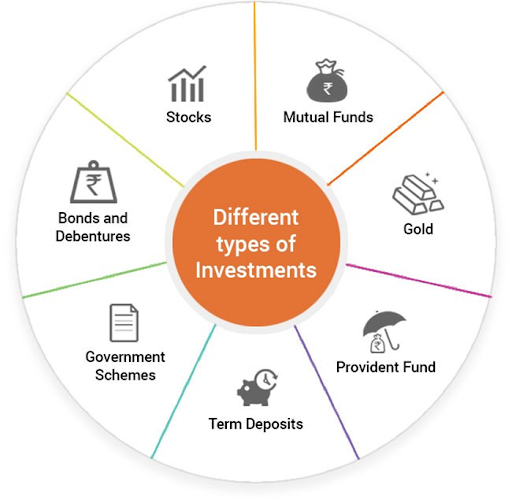

There are four main investment

types, or asset classes, that you can choose from, each with distinct

characteristics, risks and benefits.

- Growth investments. ...

- Shares. ...

- Property. ...

- Defensive investments. ...

- Cash. ...

Why stock market

is the best business ?

There are many motivating reasons to choose

trading stocks. Here are the some of the top reasons why trading stocks is

really the perfect business.

Ø

No inventory

Ø

No angry

customers or complaints, no returns

Ø

Can work from

home anywhere in the world

Ø

No paperwork -

year end statement is sent to you

Ø

No selling, no

recruiting, no networking

Ø

Compounding

effect

Ø

Recession free

business

Ø

Gives you

financial freedom

Ø

Anyone can easily

scale up

Gives you more

free time for friends and family Master of your

own destiny

What

do you mean by share?

In

simple terms, a share is a percentage of ownership in a company or a financial

asset. Investors who hold shares of any company are known as shareholders.

For example ; if the market capitalization of a company is Rs. ... 10 then the

number of shares to be issued will be 1 lakh. A share or a stock is a part of the

company that it makes available for sale. So when you buy a stock, you’re basically buying a

part of

the company.

Companies sell their shares when they need to raise money.

What

is share and types of share?

A share is referred to as a unit of ownership which represents an equal

proportion of a company's capital. A share entitles the shareholders to an

equal claim on profit and losses of the company. There are majorly two kinds of

shares i.e. equity shares and preference shares

What

is share and how it works?

Stocks,

shares and equities work by giving direct exposure to a company's

performance. Shares will rise in value when the company is doing well, and

they'll fall in value when the company is doing poorly. Stock exchanges

facilitate the exchange of shares in publicly listed companies

What is the stock market?

In

its most basic form, the share or stock market is the place where

buying

and selling of shares take place.

How does the stock market exactly work?

To

understand the process, let’s take a look at the four main parties

involved

in any share market transaction:

SEBI: SEBI stands

for Securities and Exchange Board of India and its main purpose is to make sure

that all the activities that happen in the share market are fair and do not

jeopardize the interests of any specific participant(s) involved.

Stock Exchanges:

A stock exchange is essentially the place where stock buyers meet the stock

sellers. To participate in the trading process, participants must first be

registered with the stock exchange and SEBI.

India

has these two main stock exchanges:

BSE

(Bombay Stock Exchange)

NSE

(National Stock Exchange)

Brokers: The role of

brokers (or brokerage firms) is to act as a mediator between you (the investor)

and the stock exchange to help facilitate the buying and selling of shares.

Traders: These are the people who are looking to buy or sell shares

The Process: The

process starts with a company that wants to raise money, they release the

details of their stocks that they want to sell through an IPO. An IPO

(Initial Public Offering ) is basically the first time a company sells

its shares to the public. This is the primary market stage. After this,

the company’s stocks can be traded between the sellers and the buyers.

This is the secondary market stage. But due to a large number of potential

traders, it’s not possible for them to conduct the trade at the same

time and place. Hence, stockbrokers and brokerage firms step in to act

as the intermediary party between the buyers and the stock exchange.

Now

if the trader wants to buy a share, the request is forwarded to

the

broker who sends the order to the stock exchange. The stock

exchange

then matches the traders buy request with that share’s sell request. Once both

the parties (seller and buyer) agree to the price of the share, the transaction

is finalized which is intimated by the exchange to the broker, who in turn

passes on the confirmation status to the investor. This entire process takes

place in about two days. It is important to keep in the mind the fact that the

prices of shares keep fluctuating as the demand for that stock increases or

decreases.

What is demat and trading account?

Demat

account is a repository where the digital copies of your stocks are held. If

you buy 100 shares of Tata Steel, it will be held in your Demat account. Trading

account is a platform in which you credit funds, and buy and sell shares.

Trading account enables you to do stock transactions. E.g after logging into

your trading account, and buying shares, it will be credited to your demat account.

Like, when you sell these shares, they will be digitally removed to the buyers

account. You usually require both - one to buy / sell and other to hold the scripts

that you have bought.

Yes,

you need to fund your account before you buy stock for delivery. Brokerage is

deducted from your trading account. Demat account has no role in it.

.

How

to invest in stocks in six steps

1. Decide how you want

to invest in the stock market. ...

2. Choose an investing

account. ...

3. Learn the difference

between investing in stocks and funds. ...

4. Set a budget for your

stock market investment. ...

5. Focus on investing

for the long-term. ...

6. Manage your stock

portfolio.

Why

do company issue shares?

Companies

issue equity shares to investors in return for capital, which is used to

grow and operate the firm. Unlike debt capital, obtained through a loan or bond

issue, equity has no legal mandate to be repaid to investors, and shares, while

they may pay dividends as a distribution of profits, do not pay interest

Do

you get money from shares?

There

are two ways you could make money from investing. One is if the shares

increase in value, meaning you reap a profit when you sell them. The other

is if they pay dividends. Dividends are a bit like interest on a savings

account.

Indices

What are Sensex and Nifty:

The

Sensex and Nifty are "indices(meaning indicator) of a stock

market".

There are many other indices other than these indices.

A

stock market is a place where you can sell or buy shares or

stocks

of companies. An index is basically an indicator which gives us a general idea about

stocks going up or down. The Nifty is an indicator of all the major companies

listed on NSE(National Stock Exchange). The Sensex is an indicator of all the major

companies listed on BSE (Bombay Stock Exchange). The Nifty goes up when prices

of stock of major companies on NSE goes up and it goes down when the latter

goes down. The same condition applies to Sensex. These two are the major stock

exchanges in the country. Most of the stock trading in the country is done

though the BSE & the NSE.

BSE, the first ever

stock exchange in Asia established in 1875 and the first in the country

to be granted permanent recognition under the Securities Contract Regulation

Act, 1956, has had an interesting rise to prominence over the past 143 years.

Who started BSE?

It is an integral

component of the “$1 trillion” club, having the 11th largest market

capitalisation value at $2.2 trillion. BSE stock exchange was founded by

Premchand Roychand in 1875 and is currently managed by Sethurathnam

Ravi, serving as the chairman.

Which is the

first company listed in BSE?

D.S. Prabhudas

& Company

Which was the first

company to be registered in the BSE? It was D.S. Prabhudas

& Company (now known as DSP, and a joint venture partner with

Merrill Lynch).

Who is the

chairman of BSE?

Shri T.C. Suseel

Kumar

Multi Commodity Exchange of India Ltd (MCX)

(BSE: 534091) is an independent Indian government owned commodity exchange

based in India. It is under the ownership of Ministry of Finance , Government

of India. It was established in 2003 by the Government of India and is

currently based in Mumbai.

NSE was incorporated

in 1992. It was recognised as a stock exchange by SEBI in April 1993 and

commenced operations in 1994 with the launch of the wholesale debt market,

followed shortly after by the launch of the cash market segment.

Why

was NSE formed?

National

Stock Exchange was incorporated in the year 1992 to bring about

transparency in the Indian equity markets. ... NSE was set up by a group

of leading Indian financial institutions at the behest of the Government of

India to bring transparency to the Indian capital market.

Who

is the owner of NSE?

Mr.

Vikram Limaye

is the Managing Director and CEO of NSE.

BSE Limited,

also known as the Bombay Stock Exchange, is an Indian stock exchange

located on Dalal Street in Mumbai.

Established in 1875,[5]

it is Asia's oldest stock exchange.[6]

The BSE is the 9th largest stock exchange

with an overall market capitalization

of more than ₹2,18,730 billion on as of May

2021

Now coming to how the Sensex and Nifty are calculated:

The

Nifty is calculated taking into consideration stock prices of 50

different

companies listed on BSE . The 50 companies that are

taken

into consideration are changed from time to time. This is

done

to make the Nifty an accurate index

What is MCX future?

First it is important to know mcx full form: Multi

Commodity Exchange. It is an online platform wherein commodities like gold,

silver, lead, copper, zinc, crude oil, etc. ... It is the largest commodity

futures exchange in India.

Who invented MCX?

In 2007 Jignesh Shah, founder of MCX, India's

largest commodities market, realized his long-held dream of becoming a

billionaire. At the time, his 47% stake in Financial Technologies, MCX's

parent, was worth $1.1 billion, earning him a spot on our billionaires list of

2008.

What Is the National Commodity &

Derivatives Exchange (NCDEX)?

The National Commodity & Derivatives Exchange

(NCDEX) is a commodities exchange dealing primarily in agricultural commodities

in India. The National Commodity & Derivatives Exchange was established in

2003, and its headquarters are in Mumbai. Many of India's leading financial

institutions have a stake in the NCDEX. As of September 2019, significant

shareholders included Life Insurance Corporation of India (LIC), the National

Stock Exchange of India Limited (NSE),

and the National Bank for Agricultural and Rural Development (NABARD).

7 Categories of Stocks that Every Investor

Should Know

- Income

Stocks. An income stock is an equity security that offer high yield that

may generate from the majority of security's overall returns. ...

- Penny

Stocks. ...

- Speculative

Stocks. ...

- Growth

Stocks. ...

- Cyclical

Stocks. ...

- Value

Stocks. ...

- Defensive

Stocks

A stock's fundamentals are the factors

that are thought to contribute to the underlying company's value or worth as a

business. Fundamentals can include measurable, quantitative data (like cash

flow and debt-to-equity ratio) and qualitative, situational factors (like

business model and competitive advantage).

What

are market fundamentals?

The

market fundamental (or fundamental value) of an asset is the discounted

present value of the stream of future cash flows attached to the asset. This

evidence, especially in the case of the stock market, suggests that asset

prices deviate from their fundamental values.

Who

is a father of fundamental analysis?

The

Father of Fundamental Analysis: Benjamin Graham

What

a portfolio is?

A

portfolio is a compilation of materials that exemplifies your beliefs,

skills, qualifications, education, training and experiences. It provides

insight into your personality and work ethic

What

is fundamental analysis stocks?

Fundamental

analysis attempts to identify stocks offering strong growth potential at a

good price by examining the underlying company's business, as well as

conditions within its industry or in the broader economy.

How

do you find the fundamental of a share?

How

to do Fundamental Analysis of Stocks:

1. Understand the

company. It is very important that you understand the company in which you

intend to invest. ...

2. Study the financial

reports of the company. ...

3. Check the debt. ...

4. Find the company's

competitors. ...

5. Analyse the future

prospects. ...

6. Review all the

aspects time to time

An

Initial Public Offering (IPO) refers to the process of offering shares

of a private corporation to the public in a new stock issuance. Public share

issuance allows a company to raise capital from public investors. ...

Meanwhile, it also allows public investors to participate in the offering In an

IPO, an unlisted company issues fresh shares and goes public. In

a follow-on public offer (FPO), an already listed company issues fresh

shares to new investors or existing shareholders. ... But OFS, as

previously mentioned, is for diluting promoter stake in a listed company. No

new shares are created.

Market

Capitalisation: Large-cap

companies have a market cap of Rs 20,000 crore or more. Meanwhile, the

market cap of mid-cap companies is between Rs 5,000 crore

and less than Rs 20,000 crore. Small-cap companies have a market cap

of below Rs 5,000 crore.

Ø Small Cap. Below => 5000 Cr

Ø Mid Cap. 5000 Cr => less than 20000 Cr

Ø Large Cap. 20000 Cr => More .

Stock Picking: 7 Things You Must Know

About a Company

- Earnings

Growth. Check the net gain in income that a company has over time. ...

- Stability.

Every company is going to have periods where the stock loses

value. ...

- Relative

Strength in Industry. Take a look at the company's industry overall. ...

- Debt-to-Equity

Ratio. ...

- Price-to-Earnings

Ratio. ...

- Management.

...

- Dividends

What

does fundamental mean in investing?

In

business and economics, fundamentals represent the primary characteristics

and financial data necessary to determine the stability and health of an asset.

... For businesses, information such as profitability, revenue, assets,

liabilities, and growth potential are considered fundamentals.

How do I choose stocks like Warren

Buffett?

Here's how you can build a stock

portfolio using the Oracle of Omaha's investing principles.

1. Invest in what you

know.

2. Learn the basics of

value investing.

3. Identify cheap stocks.

4. Find businesses that

will stand the test of time.

5. Invest in good

management.

6. Be aggressive during

tough times.

7. Keep a long-term

mindset.

Fundamentals of Stock Fundamentals

- Cash

flow.

- Return

on assets.

- Conservative

gearing.

- History

of profit retention for funding future growth.

- The

soundness of capital management for the maximization of shareholder

earnings and returns.

What

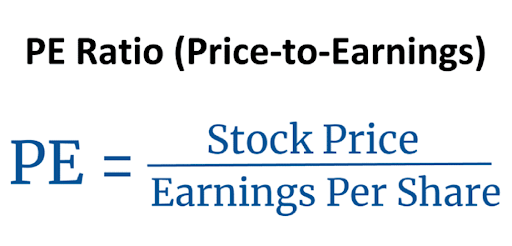

is good PE ratio?

The

P/E ratio is calculated by dividing the market value price per share by the

company's earnings per share. Earnings per share (EPS) is the amount of a

company's profit allocated to each outstanding share of a company's common

stock, serving as an indicator of the company's financial health. If you were wondering

“Is a high PE ratio good?”, the short answer is “no”. The higher the P/E

ratio, the more you are paying for each rupees of earnings. ... The market

average P/E ratio currently ranges from 20-25, so a higher PE above that could

be considered bad, while a lower PE ratio could be considered better. The

average P/E for the S&P 500 has historically ranged from 13 to 15. For

example, a company with a current P/E of 25, above the S&P average, trades

at 25 times earnings. The high multiple indicates that investors expect higher

growth from the company compared to the overall market.

What

is a good PE ratio for stocks?

As

far as Nifty is concerned, it has traded in a PE range of 10 to 30

historically. Average PE of Nifty in the last 20 years was around 20. * So PEs

below 20 may provide good investment opportunities; lower the PE below 20, more

attractive the investment potential.

The

P/E ratio, or price-to-earnings ratio, is a quick way to see if a stock is

undervalued or overvalued — and generally speaking, the lower the P/E ratio

is, the better it is for the business and for potential investors

What

if PE ratio is negative?

A

negative P/E ratio means the company has negative earnings or is losing

money. ... However, companies that consistently show a negative P/E ratio

are not generating sufficient profit and run the risk of bankruptcy. A negative

P/E may not be reported

How

is PB ratio calculated?

The price-to-book ratio (P/B) is calculated

by dividing a company's market capitalization by its book value of equity as

of the latest reporting period. Alternatively, the P/B ratio can be

calculated by dividing the latest closing share price of the company by its

most recent book value per share.

What

is a good PB ratio?

The

price-to-book (P/B) ratio has been favored by value investors for decades and

is widely used by market analysts. Traditionally, any value under 1.0 is

considered a good P/B value, indicating a potentially undervalued stock.

However, value investors often consider stocks with a P/B value under 3.

Why

bullish and bearish?

These

are the two words which represents the trends of stock

market.

In share market if prices tend to be moving upward then

you

can say that market is Bullish, similarly if price are moving

downward

then it will be called Bearish. These two are taken

from

animals Bull and Bear. There is a lot of confusion about why

Bullish

and Bearish is used to represents the trend of market but

people

are using these terms before a long time.

Bullish Trades (Bullish Market): Bullish trades means you are

going

to long in the market means you are going to buy.

Bearish Trades (Bearish Market): Bearish trades means you are

going to

short in the market means you are going to sell.

What

is trading?

Trading

is the practice of buying and selling assets over a short-term

period.

Assets here refer to any financial security, commodity, or

currency

that an economic agent purchased. Market participants

that

practice trading are referred to as traders. Trading is distinct from

investing. Investing refers to the practice of purchasing assets with the

objective of gradually growing wealth from the asset over a period of time. The

market participant may purchase a range of assets, and hold the portfolio of

assets over a period of time. While the price of the assets in the portfolio

may fluctuate over time, the goal of the economic agent is to ride out the short-term

price fluctuations and gradually earn a positive return over a period of time.

Market participants that engage in the practice of investing are typically

referred to as investors. While investors seek to earn a return, perhaps with a

range of 5% to 15%, over a year, traders seek to make such returns over a much

shorter time period, ranging from a day to a few weeks. Traders try to take advantage

of short-term price fluctuations in assets. When they execute some of these

assets may include stocks, bonds, mutual funds, exchange traded funds and other

investment instruments. A portfolio is a group of assets. The return is the

profit from an asset. It is gain (loss) from price increases (decreases) plus

the gains from dividends if any are paid. Traders can be categorized basis upon

their style of trading. The next section will explore different trading styles.

Trading styles

Trading

styles may be categorized into the following:

·

Position trading

·

Swing trading

·

Intraday trading

· Scalping

·

Position trading

: Position trading is where the position is held by the economic agent

for several weeks to several months. Position traders first try to identify

trends in the price of assets. If they expect a bullish trend, then they would

go long on the asset. If they detect a bearish trend, they may short sell the

asset. Position traders may not necessarily try to forecast the future prices

of the asset, rather they try to ride the ‘wave’ of the trend which has

been firmly established, and benefit from the overall movement of a

stock in a market. Position traders typically exit a position when the

trend breaks.

Swing trading: Swing

trading is where a market participant holds a position for

a

few days, to a few weeks. Once the trader holds more than few

weeks,

it is called position trading. Swing trading is slower paced

than

day trading since the time frame for holding trades is longer.

It

is very important that a swing trader have a trading strategy,

as

stocks will be moving up and down, but they will not be always

available to

constantly monitor the market like a day trader.

Intraday trading:

Intraday trading refers to the practice of buying and selling assets in the

same day. Positions are not held overnight. All positions are closed within the

same day. Intraday traders try to make profits by exploiting the volatility in

an asset price in a day. Like scalpers, Intraday traders profit by moving a

large volume of stocks. Intraday traders’ trading interval is the active hours

of a trading day, whereas scalpers’ trading intervals range from a few seconds to

a few minutes Traders select their trading style based upon: the size of their trading

account; their level of experience; the amount of time they are willing to

dedicate to trading; and their risk tolerance.

Scalping :

Scalping refers to where traders’ long (or short) assets, hold them for a few

seconds or minutes then close the position. Scalpers try to exploit small moves

in price by trading large volumes of the asset over a very short period of

time. Scalpers try to take

advantage of the volatility in the market.

Fundamental

Analysis (FA) is a holistic approach to study a business.

When

an investor wishes to invest in a business for the long term

(say

3 – 5 years) it becomes extremely essential to understand the

business

from various perspectives. It is critical for an investor

to

separate the daily short term noise in the stock prices and

concentrate

on the underlying business performance. Over the long

term,

the stock prices of a fundamentally strong company tend to

appreciate,

thereby creating wealth for its investors.

Fundamental

analysis focuses on studying all the financial ,

macro

and micro-economic factors that can affect the value of

a

security. Macroeconomic factors include factors like industrial

conditions

, government policies , business trade cycles etc, whereas

micro-economic

factors include the performance of a company , its

competitors

, revenues etc.

Order Types

An

order can be for intraday or positional trade. In intraday,

the

positions are squared off within the same trading session

whereas

in positional trading, either delivery is taken or it is car

ried

forward to a later date (Futures and Options). Let us discuss

about

Marker order and also other Types of trading orders:

The

following are the types of trading orders:

Market Order : Market

Order is an order to buy or sell a security at the best price at the

trading hours of the market that means if the order to buy or sell is entered

then the system will execute the orders with best prices which are

available in the market. The trader or investor do not have control on

the price in the market order.

buy

100 shares of TCS, It will match this order with lowest offer

price

available and your trade will be executed.

There

can be little difference between the price at which the

order

gets executed and the price we are seeing on our screen as

the

price we see on the watchlist is the last price at which a

transaction

took place.

Limit Order : Limit

order is a type of order in which the trader can set a price to either

buy or sell a security. In limit order the trader can set the price

unlike market order in which the trader doesn’t have control over price.

Stop-Loss Order : Stop-Loss

order is an order in which a trader can limit his or her losses through

exiting a trade if a particular price is reached. By placing a stop-loss

order, one can reduce losses if the price goes against them. When a

trader places a buy order, he is expecting that the price will rise to

earn a profit. But instead of the price rising, the price may fall.

Therefore To avoid high losses he can place a stop-loss order at a price

below the buy price.

Example:

A

trader places a buy order:

Share

price = Rs. 1600

Stop

loss at Rs. 1500

He

expects the share price to go higher, to earn profit. In case

the

price falls below Rs. 1500, say it falls to Rs. 1450.The trader

will

book a loss of Rs. 100 per share (1600 – 1500) and exit the